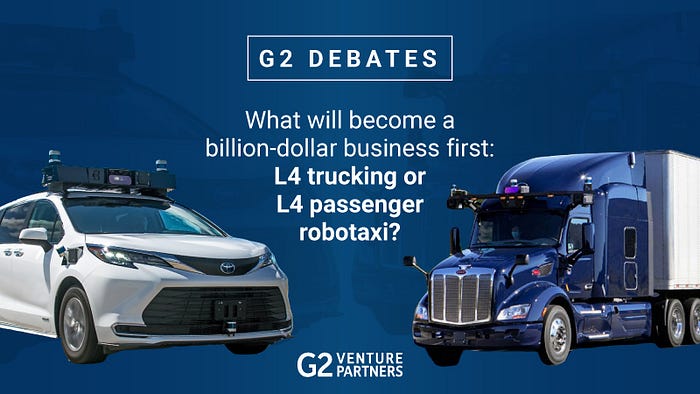

G2 Debate Series: What will become a billion-dollar business first — L4 trucking or L4 passenger robotaxi?

At G2, we believe autonomy will transform the world for the better. Internally, we often debate which application of L4 autonomy¹ is likely to be the first to become commercially meaningful, and we’re having similar debates with entrepreneurs and industry experts. In this series, Zach and Neel share their perspectives on autonomy and where we think we’ll see the first billion-dollar revenue businesses being formed.

¹ L4 (Level 4) refers to fully autonomous driving without a human driver within an operational design domain (an operating domain in which the autonomy system is designed to properly operate taking into account specific roadway types, speed range, environmental conditions, etc). SAE Levels of Driving Automation

NEEL: I’m obviously rooting for both, but I think robotaxi is running ahead of L4 trucking, here’s why:

- “If you can make it there (San Francisco), you’ll make it anywhere.” Just look at the series of impressive developments in robotaxi as of late. Cruise expanded its driverless AV service area to ~70% of San Francisco and won a permit to carry fare-paying passengers. Meanwhile, Waymo announced that it would soon start offering fully driverless rides in SF. We’re talking about one of the most complex environments in the U.S. due to heavy pedestrian and bicyclist traffic, six-way intersections, foggy weather, etc. If robotaxi firms can go driverless in SF, I believe they’ll be able to scale to several other cities in the not-too-distant future.

- All it takes is a few major cities for robotaxis to make billions. Commercializing the San Francisco 7x7 alone with robotaxis is conservatively a $1B revenue opportunity. As of 2016, ride-hail vehicles made >170K trips per weekday (SFCTA) with an average Uber fare of ~$15 for a 3-mile trip. These rides started and ended within SF’s 49 square mile city limits. Despite operating in 10K cities globally, Uber makes ~25% of its revenue from five of them. Can you guess which ones?

- Trucking seems “easier on paper,” but the stakes are higher, room for error is slimmer. On average, cars in dense environments travel 12 mph compared to highway driving speeds of 65+ mph. While there are significantly more edge cases and hazards to deal with in cities, lower speeds mean shorter stopping distances if a vehicle needs to come to an abrupt stop. In comparison, the stopping distance for a fully-loaded semi-truck going 65+ mph in ideal conditions is 500+ ft.

ZACH: You can count me as also rooting for both, but neither is around the corner, and there’s no question that trucking will be the first segment to $1B in net revenue.

- Robotaxi pilots are smaller than they appear. Robotaxi announcements are plenty, but operations are scant, limited to less populated parts of cities during limited hours and in perfect weather.

- Highways are easier environments for autonomy. edge cases will be the Achilles heel for robotaxis — the unpredictable pedestrian or the illegally parked delivery vehicle make a fully autonomous system harder to realize. Highways have fewer unpredictable situations — this is why we had L3 (autopilot) autonomy first on highways.

- Trucking has more motivation to seek autonomy. labor shortages, high logistics costs, and clogged supply chains will all push the industry towards autonomy faster than the ride-hail market, which is still only slowly recovering from the impacts of COVID-19. An autonomous truck doesn’t need to adhere to strict rules regulating trucker hours, too, so will enable much faster trucking, in addition to lower cost.

- A city full of robotaxis would be mayhem. Cities will not allow the kind of chaos on the streets that will follow once robotaxis are prevalent. Robotaxis will be risk-averse and less likely to run over pedestrians, which Malcolm Gladwell humorously took to the logical conclusion: pedestrians walking in front of robotaxis with impunity, knowing they’ll stop politely and allow them to jaywalk without consequence. A robotaxi filled city is one where sidewalks and streets have no meaning and where pedestrians halt traffic without risk or punishment.

NEEL: I’ll concede that L4 trucking has greater near-term customer pull, given chronic labor shortages. However, the industry is underestimating the challenges of high-speed autonomy.

- Former Tu Simple (L4 trucking) CEO, Cheng Lu, said it best when comparing highway to urban driving. “The challenge of a truck, if you think about an 80,000 pound Class 8 vehicle, it drives on the highway at much faster speeds, like 65 miles per hour, and it’s significantly more heavy and harder to control, harder to break. The safety implications, the reliability, are much higher.”

- Robotaxi is entering the “slope of enlightenment” on Gartner’s Hype Cycle while L4 trucking hype is fading. I remember in 2019 when the industry became disillusioned with robotaxis as every player missed its timelines by a wide margin. That’s when L4 trucking began to gain serious attention. However, I believe trucking will undergo a similar reset. The commercialization timelines I’m seeing (in some cases 2024 for “commercial scale”) seem improbable given how little driver-out testing has taken place and how undercapitalized trucking is relative to robotaxi. I believe Waymo has deployed more capital towards its robotaxi program than what has been raised by all of the L4 trucking companies combined.

- SF (the second most populated U.S. city) is putting up with the “mayhem.” The last time I was in SF, I saw Zoox, Waymo, and Cruise vehicles at the same intersection. SF is allowing hundreds of AVs to roam the streets today because they’re bought into the vision of having all-electric, shared robotaxis versus low occupancy, gas-powered cars crashing into one another and disrupting traffic flow.

ZACH: OK, to trade quotes, here’s the CEO of Pony.ai as to why there aren’t autonomous vehicles today: “In one word, it’s complexity.” The key to finding an AV-friendly market is to find a more controlled environment.

- Autonomy happens first in less complex environments. This is why autonomy happened first in the most controlled environments — indoors, with companies like Seegrid, Locus, and others making autonomous vehicles for warehouses. It’s happening now in very controlled environments — like truckyards being automated by companies like Outrider and iSee. In the near term, it will happen on public roads on specific well-known routes, driven by companies like Gatik.

- Speed isn’t the problem. Luminar makes LiDAR which can see 250 meters and at 65 mph you need 160 meters to stop a loaded semi-truck. Computers are fast enough to do the work needed in the few full seconds of time you need to decide to stop.

At G2, we could talk about this topic for hours, but we’ll call it here. What we agree on is that autonomy, whether it’s applied to semi-trucks, passenger cars, warehouses, etc., will be one of the most transformative technologies on the planet in the next 1–2 decades. We’re starting to see proof points that suggest commercialization may not be as far off as we originally thought. What do you think?

#autonomousdriving #robotaxi #L4trucking #Waymo #Cruise #Luminar #Zoox #TuSimple #PonyAI #Locus #Outrider #Gatik #Seegrid #iSEE