The Future of Bitcoin (at least in energy use…)

Bitcoin receives most of its press based on its daily price fluctuations, as investors / speculators chase outsized returns. However, the topic driving the (distant) second most press on bitcoin is its energy usage. Bitcoin today, as a network, uses more electricity than most countries in the world. And, there are a few factors that could drive that electricity usage even higher — namely, an increasing bitcoin price and cheaper electricity costs around the world. So, I thought it would be fun to take a few minutes to understand the factors that determine bitcoin’s electricity use and see if we could provide any insights about how this electricity use might change over the next ten years!

First, what is the bitcoin network using energy for?

The bitcoin network, as you might know, is maintained by bitcoin “miners”. These miners are providing the network their computing power, to verify transactions, in exchange for the chance to receive bitcoin.

To get slightly more technical, these miners use computers that are competing to solve a cryptographic puzzle. This puzzle is essentially to guess a random sequence of characters (you can read more about the actual math here, if you are interested!) These puzzles are designed to get harder as more computing power is thrown at them, such that they always take ~10 minutes for the network to solve. The computing power in the bitcoin network is generally measured in “hashes”, which is basically your computer making one guess. Your purpose built bitcoin mining computer might have something like “5 TH/s” of computing power (TH = terahashes), which means that it can do 5 trillion “guesses” per second. The total bitcoin network is currently running at ~145 million TH / s, which means that your 5 TH/s computer would account for 0.000003% of the global bitcoin network.

Then, at the end of ~10 minutes (this 10 minutes is an average, as there is inherent randomness with all of these computers guessing solutions), someone solves the puzzle and receives the block reward. This block reward is a set amount of bitcoins, which is halved on a consistent schedule (because the amount of total bitcoins that will ever exist is capped at 21M, which we expect to get to in the year ~2140). Currently, the reward is 6.25 bitcoins, but in 2024, it will be halved again, and again in 2028. So, in 2028, the reward for a block will be ~1.56 bitcoins.

So, that is bitcoin mining! Essentially, the bitcoin miners are buying electricity (to run their computers) in exchange for a chance at winning bitcoin.

So, how much energy is used in mining today?

Currently, it is estimated that the bitcoin network is using ~105 TWh of electricity annually (but, this fluctuates — you can see the up-to-date estimates here). This implies that the entire bitcoin network uses ~13 GW of power (running for 8,760 hours in a year -> hence, 105 TWh of consumption).

This is a ton of electricity! This would put bitcoin at about 33rd in a ranking of countries by electricity consumption. This means bitcoin uses more electricity than countries such as Belgium, Switzerland, and Israel.

Why is this concerning? Well, primarily because bitcoin mining is fairly dirty today — it often happens in countries with carbon intensive grids. It is estimated in 2020 that <40% of bitcoin mining electricity comes from renewable sources. And, with an estimated 500 g of CO2 / kWh carbon intensity, this would yield a carbon footprint of ~60 Mt. This is equal to about 12.5 million cars.

So, how can we predict the future energy use of the bitcoin network?

There are a two key factors that determine the energy consumption of the bitcoin network.

Bitcoin Price: Mining bitcoin is an investment decision, and if the price of bitcoin rose, we would expect more miners to enter the market (and thus to consume more energy). The converse is also true.

Price of Electricity: The price of electricity varies throughout the world, and so many bitcoin mining farms are in areas with very cheap electricity. Today, most of the world’s bitcoin mining is in China. But, as electricity gets cheaper, it can be more profitable to mine bitcoin, and again, more miners will enter the market.

And that is basically it! Although other factors will go into the performance of a specific bitcoin mining operation (namely the efficiency of their computing power, as compared to other folks of the network), these factors don’t actually change the overall energy to bitcoin equation as long as we assume that this market is relatively efficient. In this case, an efficient market would imply that the amount of computing power in the network will flex such that the cost to mine a bitcoin provides a fair return to miners. Experts estimate that this equilibrium is when electricity costs are about 60% of bitcoin revenue for a miner. Interestingly enough, today electricity costs for miners are on average higher (as much as 100% of bitcoin revenue) which could imply that miners are speculating a bit on the price of bitcoin?

So, what will the electricity use of the bitcoin network be in the future?

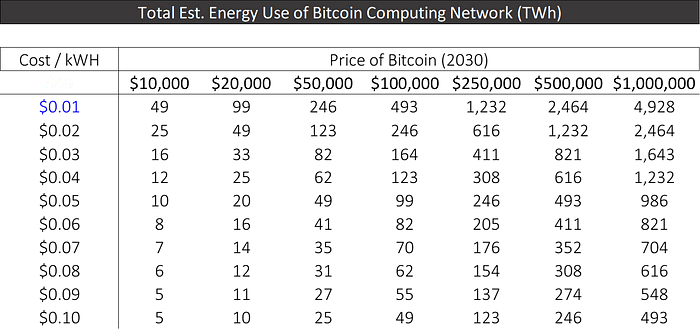

With these key factors, we can estimate what future electricity consumption will be at various prices of bitcoin and costs of electricity (see below).

Remember that current bitcoin electricity use is ~105 TWh, but that this chart is for 2030, when the block reward for bitcoin will be 1/4 of what it is today.

I am personally not taking any view on what the price of bitcoin will actually be in 2030 — I have no idea. However, there are many bitcoin enthusiasts who estimate it will be well over $300K by 2030. One bull case for bitcoin views it as comparable to gold as a “store of value” — well, if bitcoin equaled gold’s market cap, a bitcoin would be worth ~$500K. So, assuming that these bitcoin miners are able to secure favorable electricity rates (and, with wind power currently driving electricity prices down toward $0.02 / kWh, there is no reason to think they cannot), bitcoin’s network could use 500+ TWh of electricity annually by 2030. This would be more than all but 8 countries (by today’s numbers).

Alternatively, if bitcoin stalls out in price, it is likely the energy consumption of the network will gradually reduce as the block reward is halved twice to 1.56 bitcoins / block. Given the less attractive reward, less computing power will be applied to the network.

Is this an efficient use of resources?

So, we have highlighted two issues for bitcoin. The first is the use of carbon-based electricity — however, this is likely to continue to decrease as renewables become ever cheaper, and bitcoin mining becomes even more competitive. Additionally, major ecosystem players are stepping up to make bitcoin mining more sustainable — for example, Square just announced $10M dedicated to promoting renewables in bitcoin mining.

However, it is also interesting to wonder if bitcoin is an efficient use of resources. There was a really good blog on Digiconomist recently that, among other things, estimated the energy cost of a Visa transaction vs. a bitcoin transaction (I’ll summarize the Visa v. Bitcoin point below, but I really recommend that blog for additional reading if you find this subject interesting!).

First, what is the electricity requirement of a bitcoin transaction? Well, there are about 300K bitcoin transactions / day, or 110M per year. Given that the bitcoin network uses 105 TWh of electricity per year, this yields a per transaction electricity footprint of ~950 kWh.

Meanwhile, Visa consumed ~0.2 TWh for all of its operations in 2019. And, Visa processed 138 billion transactions in 2019. This yields a per transaction electricity footprint of 0.001 kWh. This means that 1 bitcoin transaction uses almost as much electricity as 1 million Visa transactions!

We shouldn’t be completely surprised by this — after all, the concept of bitcoin is essentially replacing centralized human oversight with energy use, as a way to regulate financial activity. However, I was surprised by the magnitude — in a time when we are all trying to reduce our energy use, using bitcoin could seem almost wasteful (depending on how you personally value the decentralization of money, of course).

So, where will bitcoin go from here? Only time will tell, but I hope that more bitcoin miners are able to utilize excess electricity in mining. As one cool example, this company, Layer1, works with electric grids to mine bitcoin using excess renewable electricity, but shuts down mining when the grid needs its electric supply for homes. This way, it does not compete with other users for constrained electric supply.