The Grid’s Transformation: Batteries Will Reshape the Modern Grid 150 Years After Its Invention

Authors: Brook Porter and Jasper Platz | G2 Venture Partners

The grid is undergoing the most remarkable transformation since its invention by Thomas Edison and George Westinghouse 150 years ago. The deployment of cheap, renewable energy has ushered in a new era of how we produce electricity. The next phase of this transformation is solving the intermittency problem of renewables. In this post, we will focus on the potential of batteries to address the problem. We explore how cheap batteries could get and how ubiquitous, low-cost energy storage might lead to a future where a significant portion of electricity never touches the grid.

The Rise of Renewables and the Problem of Intermittency

Renewable energy production is breaking new records daily — not because it’s greener, but because it’s the cheapest way to generate electricity. However, solar and wind have a major problem: they are intermittent. Production varies over time and doesn’t always align with demand.

The grid absorbs the excess electricity and operators adjust energy prices accordingly. During the hours when we don’t consume all electricity produced, wholesale electricity prices drop close to zero and sometimes turn negative.

- In the US Southwest electricity rates drop below zero for 1–3 hours per day.

- In Europe, countries like Germany have 300 hours per year with an average price of -€13/MWh. Renewable producers have to pay the grid to take their electricity.

As a result, renewable asset owners see lower revenues and expected returns. Without a solution, renewable deployments will eventually slow as the grid’s ability to absorb intermittent capacity saturates.

However, intermittency and the resulting price volatility create an arbitrage opportunity: the chance to “buy low and sell high”. All we need is a technology that can store electricity cheaply enough to profit from intraday price swings.

The Battery Cost Revolution

Until recently, batteries were too expensive.

- 5 years ago: A grid scale 4-hour battery system cost $350–400/kWh.

- If we translate that into a levelized cost of storage, it would cost $0.20–0.25 to store 1 kWh for up to 4 hours.

- If you compare that to utility-scale solar production cost of $0.04–0.08/kWh, battery storage was simply too expensive and grid price volatility wasn’t great enough to make a battery installation economically viable.

However, two major shifts are changing at the same time:

(1) Growing intermittency arbitrage (as more renewables come online)

and

(2) Dramatic decline in lithium-ion battery costs, with the growth of electric vehicles

Figure 1 — The famous duck curve that is getting more severe every year as more wind and solar get deployed and the energy arbitrage widens (between the lows and highs).

Figure 2 — The dramatic drop in lithium-ion battery prices over the past 10 years

How Low Can Battery Costs Go?

Battery costs have declined by 80% in the last 10 years, an incredible trend few predicted. In fact, prices are dropping so fast it’s hard to keep up. Earlier this year, Lithium Iron Phosphate (LFP) cells hit $50/kWh in China.

That begs the question how cheap can they get? And can batteries solve our intermittency problem?

Learning curves of batteries

Wright’s Law is the closest thing we have to a crystal ball predicting the prices of energy technologies. The basic idea behind Wright’s Law is the more we produce something, the better we get at it driving down its costs. With energy technologies, the smaller the unit size, the steeper the learning curve. Wright’s Law has been busy at work driving down the cost of lithium-ion batteries as EVs have massively increased the demand for battery production. Gigafactories are sprouting up everywhere, especially in China where most batteries are produced today.

Batteries are complex systems and to predict their future costs, we need to break them down into key components. Let’s look at the rough cost structure of a 4-hour utility-scale battery system today:

Learning curves for each of these components will be different. Improvements in construction costs will likely be slower than that at the cell level (through e.g. chemistry improvements or manufacturing automation). For the purpose of this exercise, we’re assuming a learning rate of 18% on the cell level and 10% for all other components. That would get us to the following cost structure by 2032:

At $27/kWh, lithium-ion cells might start hitting the lower bound of their raw material should-costs. However, newer battery technologies like Form Energy’s iron-air batteries or CATL’s sodium-ion batteries have a much lower material cost bound which would allow battery prices to continue to decrease down the cost curve.

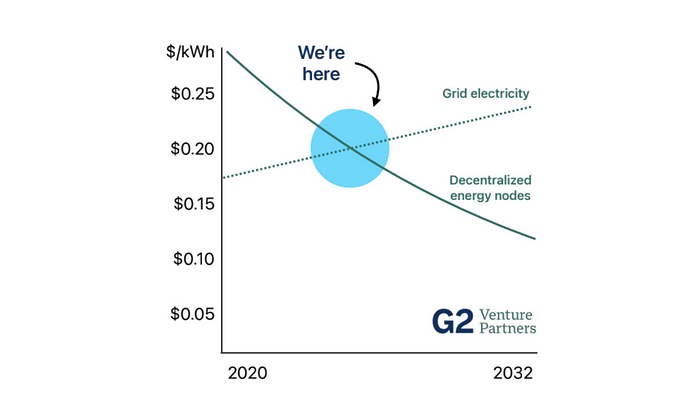

With system cost at $145/kWh for utility-scale systems, the implied levelized cost of storage would be below $0.08/kWh for a 4-hour battery. If we assume we can produce solar energy at $0.04/kWh and need to store about ⅓ of it, the cost of utility-scale solar with storage would come out to $0.07/kWh. For large commercial and industrial (C&I) installations, the cost will likely be higher at around $0.11/kWh (due to lower economies of scale). That would still be less than half the cost of commercial electricity rates in California and Europe in 2032. (On an unsubsidized basis while current incentives like the IRA potentially pull the economic feasibility of batteries forward.)

Figure 3 — Cost curve of solar and storage (unsubsidized) compared to US grid electricity prices

The Path to a Decentralized Future

This cost trajectory points to a fundamental shift in our energy infrastructure. Solar combined with batteries would become the ubiquitous solution to provide cheap electricity to homes and businesses in many parts of the US and Europe.

Key implications:

- In contrast to centralized energy generation, the modularity of solar enables massively distributed energy nodes. When combined with batteries, these nodes become “stable energy nodes”, providing consistent power over 24-hour periods.

- Millions of homes, industrial facilities, and warehouses will produce and store a large portion of their power on-site and behind the meter.

- The grid would become a backup power source for longer-duration renewable energy fluctuations.

The Unsolved Problem of Long-Duration Storage

Today, nearly all battery installations are providing short duration back-up of 2–8 hours, which begs the question: can batteries solve long-duration intermittency?

This cost curve exercise has shown that batteries will become cheap enough to solve daily intermittency. If existing batteries can approach their theoretical should-costs, or an emerging technology like iron-air or sodium-ion can gain commercial traction, we might see multi-day storage from batteries become the predominant solution to longer duration intermittency (addressing outages from cloudy conditions or low-wind periods).

One key question remains, how long is long enough to meet our grid reliability requirements?

Currently, the best, most mature technology we have to address longer-term intermittency are gas-powered peaker plants that are on standby and provide capacity when needed. While they are fairly economical, they have a significant carbon footprint. The greenest established technology is pumped hydro where we use cheap renewable power to pump water into large elevated reservoirs and release it downhill to power generators when needed. The main limiting factor is having the right geography and overcoming conservation concerns to build large reservoirs into mountains. The cost for pumped hydro also remains a challenge, and Wright’s Law won’t do much to help this technology.

For the most common types of weather-related intermittency, 100-hours appears to be a suitable size at a reasonable cost point target — but we’ll need to see how changing weather patterns impact reliability with this assumption. Seasonal intermittency might be best addressed by simply overbuilding wind and solar so it’s sized for low-production/high-demand months resulting in significant overproduction in other seasons.

New technologies, at lower price points, are needed to solve multi-day and seasonal intermittency. Various other contenders exist, e.g. novel combustion engines, solid-oxide fuel cells, flow-batteries, compressed air storage; and technologies that are beyond the scope of this article.

The Future of the Grid

When Thomas Edison built the first power plant in 1882, he was convinced that electricity would be generated locally and distributed over short distances. That turned out to be wrong. His rival, George Westinghouse, pursued a vision that became the blueprint for the modern power grid: large centralized power plants and an AC grid that can distribute power efficiently over hundreds of miles. It’s the cheapest way to supply electricity to millions of households and businesses.

Until now.

With Wright’s Law driving down the cost of stable, modular and decentralized energy generation and storage, coupled with the inevitable increase in rates from grid-related upgrades needed to modernize and harden our grid, we will likely see a new hybrid grid emerge where local energy production and storage is cheaper than grid electricity. As a result, a large percentage of electricity will never touch the grid. If a city, industrial site, or data center has access to low-cost long-term storage like pumped hydro or a gas-powered peaker plant, they could form micro-utilities and fully defect from the grid.

This transition to a more decentralized grid will take decades to play out. Battery cost curves need another few years to mature. In the meantime, solar costs will also continue to decline. The resulting shift away from centralized power plants to decentralized energy nodes will inevitably reshape the grid. We’re just in the early innings of a remarkable transformation.